Short-Term Health Insurance Business Ideas to Start in 2024

Contents

Short-Term Health Insurance Business Ideas to Start in 2024

The insurance landscape is evolving, especially in the realm of short-term health insurance. For small business owners and aspiring entrepreneurs, this niche offers a wealth of opportunities. Whether you're looking to provide valuable services or develop innovative solutions, exploring these business ideas can set you on a successful path.

Overview of Short-Term Health Insurance

Short-term health insurance offers temporary coverage for individuals who need insurance outside the open enrollment periods. As economic conditions fluctuate, the demand for such plans has surged. Many people are seeking flexible options to bridge gaps in their coverage — whether due to job changes, health issues, or waiting for more comprehensive plans to kick in. Establishing a business in this area not only meets an urgent need but also presents significant growth potential.

Business Ideas for Short-Term Health Insurance

Delve into these various business ideas that can capitalize on the growing market for short-term health insurance.

Independent Insurance Broker

As an independent insurance broker, you can connect clients with short-term health insurance options from multiple providers. This role allows you to offer tailored solutions based on individual needs, helping clients navigate the complexities of different plans.

- Why it works: Personalization builds trust, and being an independent broker helps clients find the best deals.

Online Insurance Marketplace

Creating an online platform that compares various short-term health insurance plans increases transparency in the market. Users can analyze options on cost, coverage, and provider reputation, making informed choices.

- Why it works: People love convenience, and having resources at their fingertips will draw a large audience.

Specialized Coverage Consulting

Offering consulting services that focus specifically on short-term health insurance needs is another brilliant idea. With so many choices available, clients can feel overwhelmed. With your expertise, you can guide them in selecting suitable coverage tailored to their requirements.

- Why it works: Providing specialized knowledge adds significant value to the experience.

Health Insurance Apps

The rise of mobile applications makes this an exciting opportunity. Building a health insurance app that helps users manage their short-term policies, reminders for renewals, and access to medical professionals provides boundless benefits.

- Why it works: Today’s consumers expect mobile solutions that simplify their complex lives.

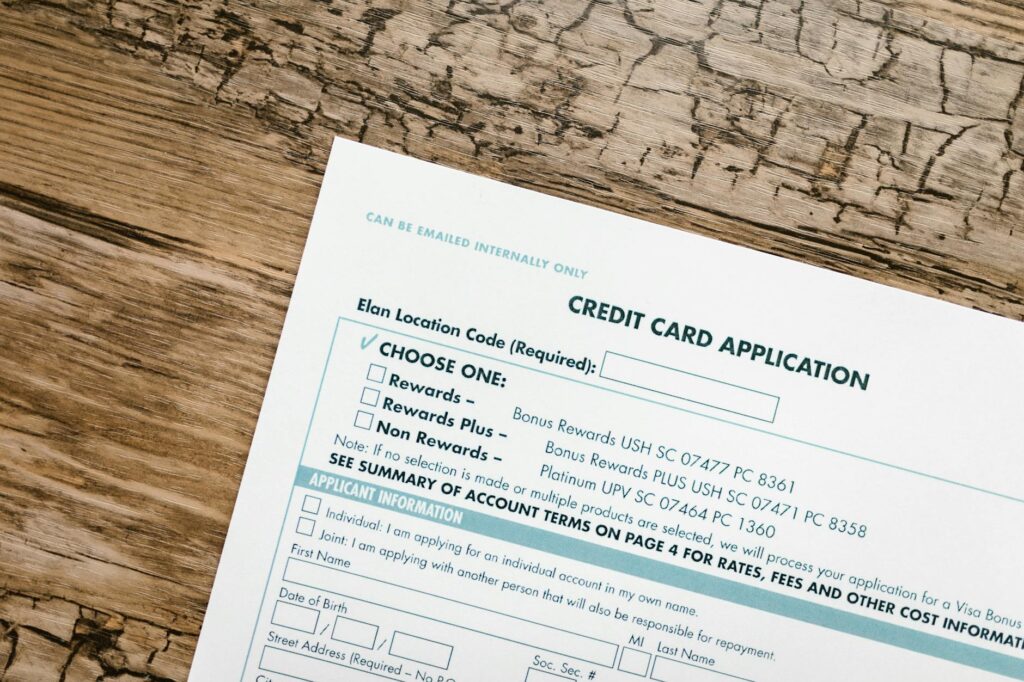

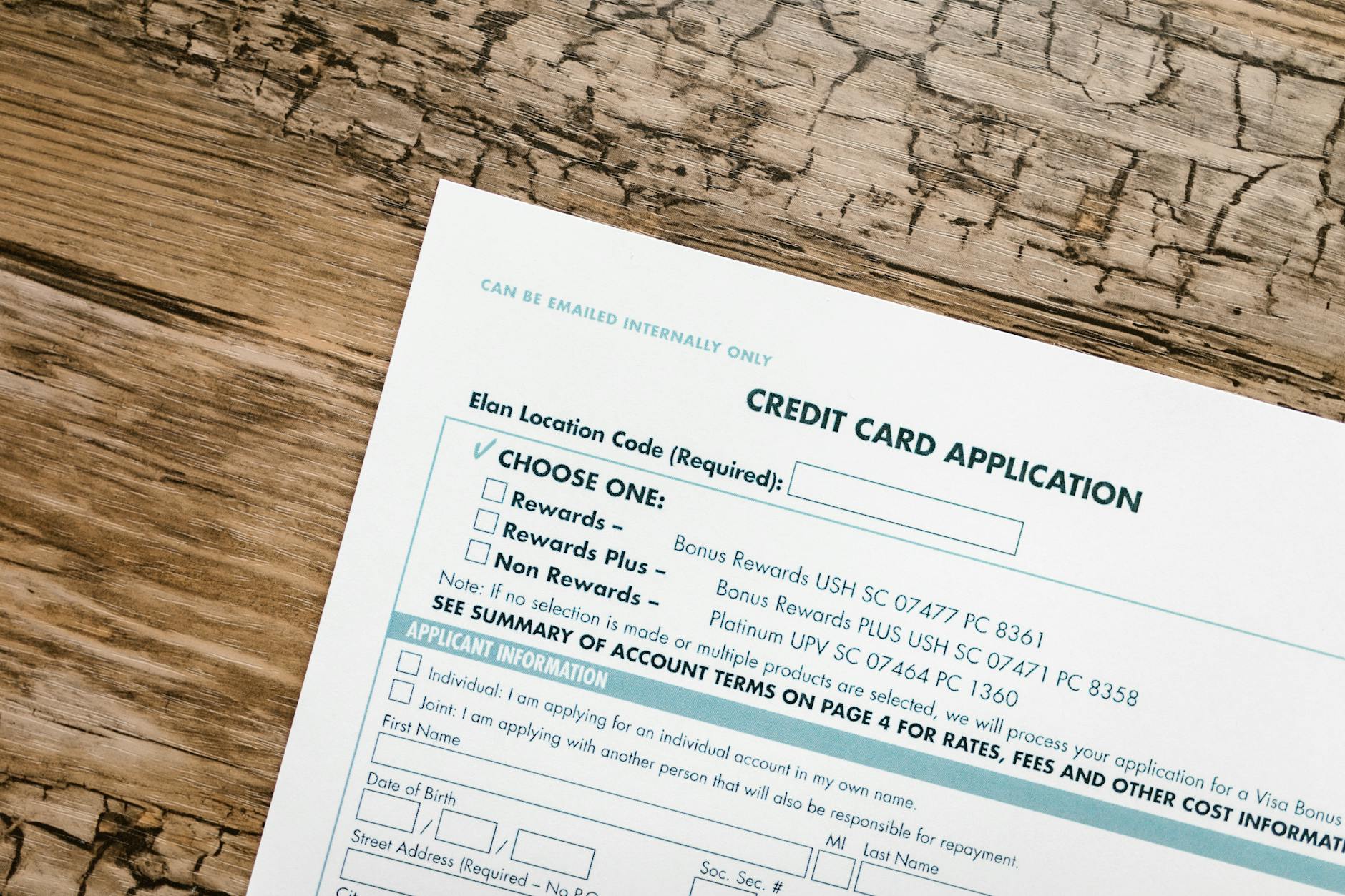

Photo by RDNE Stock project

Niche Market Targeting

Identify specific demographics such as freelancers, gig workers, or seasonal employees. Tailor short-term health insurance products to cater specifically to the needs of these groups, addressing their unique health care challenges.

- Why it works: Smaller markets often have specific needs that are not fully addressed by mainstream insurers.

Affiliate Marketing for Insurance Products

Teaming up with insurance providers through affiliate marketing can be a lucrative strategy. Promote their services on your content platforms and earn commissions for every client that signs up through your referral.

- Why it works: There’s almost no upfront cost, making it safe for you to explore.

Health Savings Account Management

Complement your offerings by managing Health Savings Accounts (HSAs). This service adds additional value for clients and can simplify the process of navigating funds for their healthcare expenses.

- Why it works: Many don’t fully understand HSAs—your expertise can demystify and maximize their benefits.

Short-Term Insurance Education Programs

Organizing educational programs, workshops, or webinars focused on the benefits of short-term health insurance will cement your role as a thought leader in this space. Inform clients about the options and best practices in coverage.

- Why it works: Consumers often purchase plans from those they trust and recognize as knowledgeable.

Customized Health Plans

Create bespoke short-term health insurance plans specifically designed for businesses looking to offer unique solutions for their employees. Personalization encourages loyalty and can increase overall satisfaction.

- Why it works: Every business has different needs—a one-size-fits-all approach doesn't work here.

Corporate Partnerships

Form strategic partnerships with corporations and businesses to offer short-term insurance as part of their employee benefits. Tailored solutions for a corporate environment can help you tap into a larger audience.

- Why it works: Many companies are seeking ways to support their employees' health needs, providing mutual benefits.

Insurance Plan Bundling

Consider bundling short-term health insurance with other services like dental and vision. Creating comprehensive packages can entice clients with the convenience of having all their health insurance needs met under one roof.

- Why it works: Bundling often lowers overall costs for the customer while increasing value.

Social Media Campaigns for Insurance Awareness

Leverage social media platforms to run informational campaigns about short-term health insurance options. Engaging visuals or quick snippets of advice can catch attention and drive traffic to your offerings.

- Why it works: The majority of consumers participate in social media, making it a perfect venue for awareness campaigns.

Health Insurance Advocacy Group

Creating a non-profit organization focused on advocating for consumer rights regarding short-term health insurance ensures that clients’ voices are heard. You can arrange community initiatives to educate and protect underserved populations.

- Why it works: Establishing goodwill while realizing community-focused goals promotes your brand and its values.

Telehealth Integration with Insurance Plans

As telehealth becomes increasingly popular, integrate it into your short-term health insurance offerings. Providing remote healthcare solutions as part of your service enhances the customer experience and addresses modern healthcare demands.

- Why it works: New technologies in healthcare draw interest and provide tangible benefits right away.

Effective Branding Strategies

Branding is crucial for your business's success. Creating a strong brand identity will resonate with potential clients and position you as a market leader in short-term health insurance.

Creating a Memorable Logo

A well-designed logo is vital for establishing your brand identity. Create a design that captures the essence of your business and appeals to your target market.

- Tip: Ensure your logo reflects trustworthiness and professionalism.

Building a Strong Online Presence

Having a professional website and active social media profiles is essential. Make sure your online presence is user-friendly and offers informative content to attract potential clients.

- Tip: Your website should serve as a hub of resources for anyone interested in short-term health insurance.

Conclusion

As you explore these short-term health insurance business ideas, remember that each presents unique opportunities for growth and innovation. The landscape may be competitive, but with the right strategies and a strong brand identity, your venture can shine. Stay committed, keep learning, and take action to turn your entrepreneurial dreams into reality!

As our Chief SEO & Branding Strategist, Robert Ellison is a digital marketing visionary with over 25 years of experience transforming brands through smart, data-driven SEO and impactful storytelling. Known for his expertise in aligning technical SEO with authentic brand narratives, he leads our team in creating strategies that boost search rankings while building strong, sustainable brand identities. A trusted advisor and frequent industry speaker, Robert combines deep technical knowledge with creative insight, helping our clients not only reach the top of search results but also genuinely connect with their audiences.